A major a part of Tesla’s progress in gross revenue final quarter got here from a rise in earnings from servicing Tesla’s autos and promoting power via its Supercharger community – issues Elon Musk stated Tesla wouldn’t goal to make earnings from.

Again in 2016, Elon Musk was quoted saying this at a Tesla occasion when defending the automaker’s technique to function its personal service facilities moderately than utilizing dealerships:

Our philosophy with respect to service is to not make a revenue from service. I feel that it’s horrible to make a revenue on service.

Musk typically criticized different automakers, particularly GM, for promoting “automobiles that then want service” at dealerships after which making a variety of earnings promoting substitute elements to clients via these dealerships.

The CEO is usually quoted saying, “The very best service isn’t any service,” and Tesla goals to enhance service by growing the reliability of its autos, leading to much less want for service.

Actuality is sort of totally different. Tesla homeowners are sometimes experiencing lengthy wait occasions to get service appointments at Tesla and the way the automaker plans to handle this case was a prime query throughout Tesla’s earnings name yesterday.

As for the Supercharger community, Musk additionally stated that it might “by no means change into a revenue middle” for Tesla.

The CEO all the time stated that the aim was of the charging community was to be a service for Tesla homeowners, and now non-Tesla homeowners, with the aim of revinesting income into rising the capability of the community.

Tesla’s actuality is altering

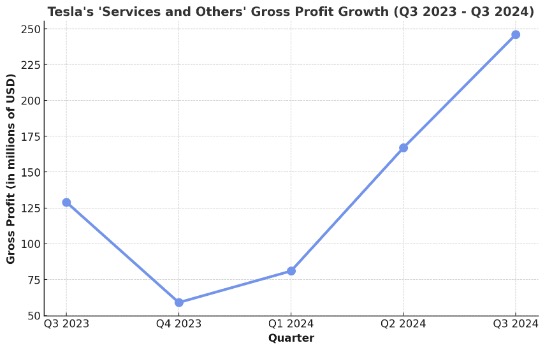

Over the past two quarters, Tesla’s earnings from “providers and others” have surged.

For the previous few years, Tesla’s providers and others had been solely marginally worthwhile, which was according to Musk’s beforehand said technique on that entrance, however one thing has modified.

With Tesla’s Q3 2024 monetary outcomes, the automaker that “providers and others” gross earnings jumped to nearly $250 million – a 90% enhance year-over-year:

Tesla is among the most opaque automakers in the case of breaking down its financials. It bundles many issues into “providers and others, ” making it exhausting to know precisely what’s going on inside.

The majority of that accounting line has traditionally been automobile service and used automobile gross sales, however in Tesla’s newest monetary outcomes, which noticed an necessary enhance in earnings for “providers and others”, the automaker confirmed that the surge was particularly as a result of its Supercharger community and repair margins:

The Providers and Different enterprise achieved a file gross revenue in Q3, rising over 90% year-on-year. Sequential progress in gross revenue was pushed principally by increased gross revenue technology from supercharging, service middle margin enchancment and better gross revenue technology from Elements Gross sales and Merchandise.

Now at $~250 million, it’s nonetheless a small a part of Tesla’s general gross earnings, however it does account for a big a part of the ~$800 million enhance in gross earnings in comparison with final 12 months.

Electrek’s Take

That is one thing that irritates me personally as a result of I’ve used these quotes from Elon about service to counter the hesitation of many potential Tesla consumers relating to the upkeep and repair of electrical autos.

Elon’s assertion reassured them, but when that was ever actually the plan, it actually isn’t anymore based mostly on the most recent outcomes.

Tesla’s gross margins for service and promoting substitute elements are surging, and Tesla is proudly saying it in its monetary outcomes.

Myself, I’ve two Tesla autos that want service proper now and Tesla is attempting to promote me very costly elements.

As for Supercharger, costs are going up.

To be honest, Tesla making a living on the Supercharger community is sort of new and the corporate is simply beginning to promote extra charging to non-Tesla EVs. It’s very potential that Tesla would possibly want to regulate to maintain the Supercharger simply marginally worthwhile.

It’s simply the truth that Tesla writes “sequential progress in gross revenue was pushed principally by increased gross revenue technology from supercharging,” it’s not tremendous encouraging.

However within the meantime, some Supercharger stations are getting fairly costly. Hopefully, Tesla will get these costs into management

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.