Ford reported Q3 earnings after the market closed on Monday, beating Wall St income and EPS expectations. Nonetheless, the corporate continues to be dropping billions on its EVs. Right here’s a more in-depth take a look at Ford’s third-quarter 2024 earnings report.

Third-quarter earnings preview

Ford’s US retail gross sales rose 3% within the third quarter, with general gross sales up 1% in comparison with Q3 2023. Total automobile gross sales are actually up 2.7% by the primary 9 months of 2024.

Regardless of the expansion, Ford was outpaced by GM and Hyundai Motor Group (together with Kia and Genesis) in US electrical automobile gross sales.

Ford’s EV gross sales have been up 12%, with 23,509 automobiles offered in Q3. Nonetheless, with a file 32,095 EVs offered, a rise of 60% 12 months over 12 months, GM topped its crosstown rival. With 70,450 EVs offered, GM is now forward of Ford at 67,689.

GM topped estimates final week, reporting $48.8 billion in third-quarter income. Though the corporate doesn’t present a separate EV breakdown, it says it’s “nearing the crossover level to profitability for EV gross sales.”

After dropping one other $1.1 billion on its Mannequin e enterprise, Ford’s EV losses reached $2.5 billion by the primary half of 2024. Ford expects EV losses to succeed in between $5 billion and $5.5 billion this 12 months.

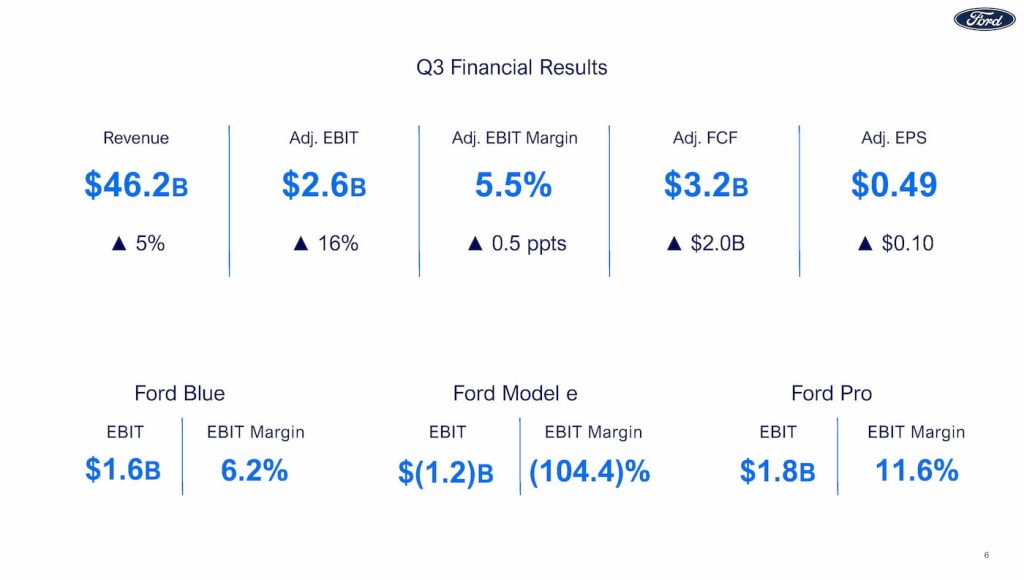

In accordance with Estimize, Ford is predicted to report complete Q3 income of $45.2 billion with an EPS of $0.42.

Ford beats Q3 earnings, however EVs put a drag on earnings

Ford reported Q3 income of $46 billion and an Adjusted EPS of $0.49, topping Wall St estimates. This was Ford’s tenth consecutive quarter of YOY development.

- Q3 2024 Income: $46 billion vs $45.2 billion anticipated.

- Q3 2024 Adjusted EPS: $0.49 vs $0.42 anticipated.

In the meantime, Ford’s web earnings slipped 25% to $900 million within the third quarter. The corporate stated the decrease earnings included a $1 billion “electric-vehicle associated cost” amid its technique shift.

The corporate’s industrial and software program enterprise, Ford Professional, continues to be the primary development driver, with quantity and income up 9% and 13%, respectively. The unit additionally generated $1.8 billion in working revenue with an EBIT margin of 11.6%.

Regardless of this, Ford’s electrical automobile enterprise continues to really feel the stress. Ford Mannequin e misplaced one other $1.2 billion in Q3.

Though income slipped 33% to $1.2 billion, Ford stated decrease materials and battery prices enabled it to realize practically $1 billion in price enhancements year-to-date.

The enhancements weren’t sufficient to beat “industry-wide pricing stress,” as Mannequin e losses reached $3.7 billion by the primary 9 months of 2024.

“We’re in a robust place with Ford+ as our {industry} undergoes a sweeping transformation,” Ford’s CEO Jim Farley stated on Monday.

Farley stated the corporate has taken “powerful motion” to create benefits in key areas like software program and next-gen EVs.

Ford expects to lose round $5 billion on its Mannequin e enterprise in 2024. The corporate now expects adjusted EBIT of round $10 billion, on the decrease finish of its $10 to $12 billion vary.

Ford’s inventory was down practically 5% following its Q3 earnings launch as buyers hoped for higher steering.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.